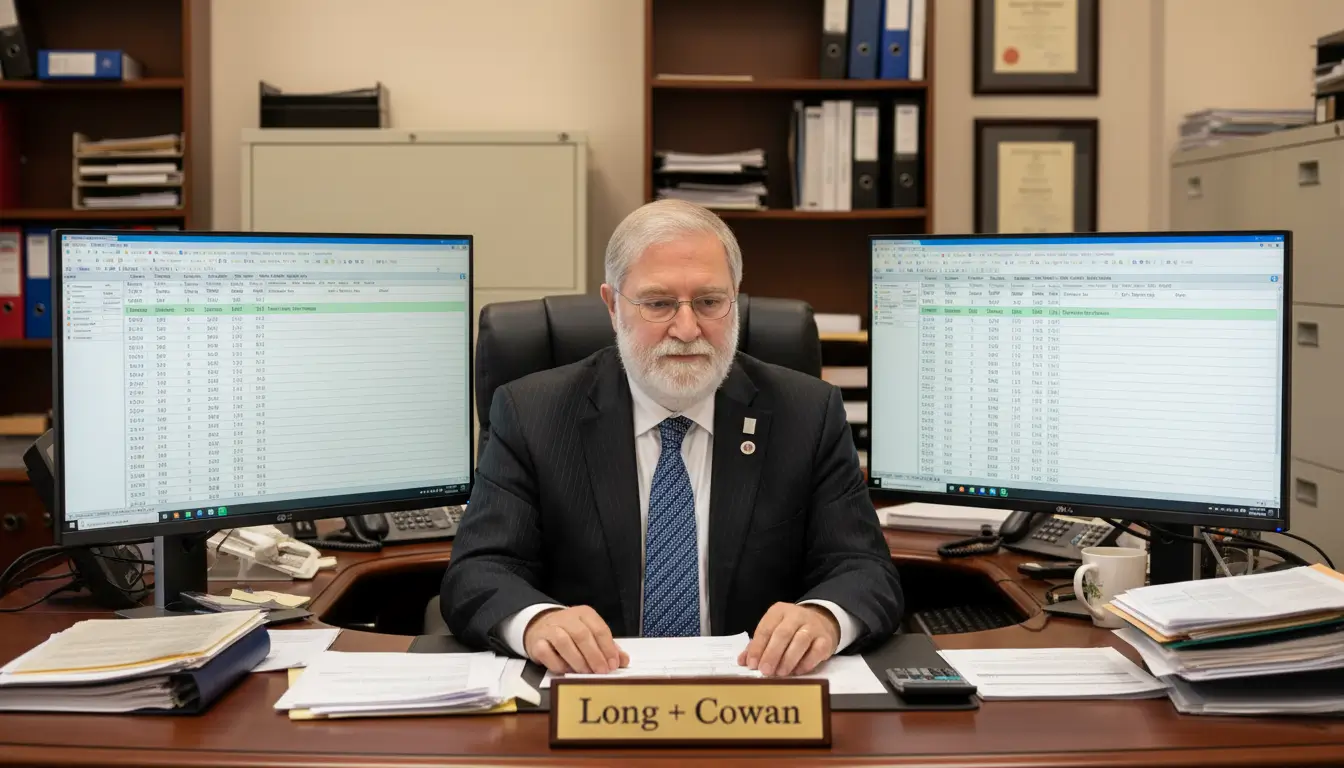

For over 75 years, Long + Cowan Chartered Accountants have been a trusted name in Wellington’s business community. Our Wellington Payroll Services provide clarity, compliance, and peace of mind for small to medium-sized enterprises that need reliable financial support. We go beyond processing pay runs; our focus is on building lasting relationships and helping businesses operate smoothly and confidently.

When you partner with us, you are supported by a team led by Ben Stockbridge, backed by decades of accounting expertise and a reputation for service built on trust. With Long + Cowan, payroll is no longer a task to worry about but a system that supports growth, compliance, and team satisfaction.

Understanding Payroll Services

The Basics of Payroll Management

Managing payroll involves far more than paying salaries. It requires precision in calculating hours, wages, leave, deductions, and taxes, as well as ensuring compliance with Inland Revenue regulations. Your employees depend on prompt and accurate pay, while your business relies on consistent record-keeping and timely filings.

The Importance of Accurate Payroll Processing

Accuracy is essential. Payroll errors can damage morale, attract penalties, and disrupt operations. By ensuring every employee is paid correctly and on time, your business strengthens its reputation for professionalism and fairness.

Benefits of Outsourcing Payroll

Time and Cost Savings

Outsourcing payroll frees up valuable time, allowing you to focus on running and growing your business. It also reduces costs compared to managing payroll in-house, minimising the risk of errors and compliance breaches.

Access to Professional Expertise

Working with experienced accountants means your payroll is handled by professionals who stay current with legislation and industry standards. You gain peace of mind knowing that your compliance and accuracy are in expert hands.

Compliance and Risk Management

Payroll involves complex legal requirements. Our services ensure your business remains compliant with all employment and tax regulations, avoiding unnecessary fines or stress.

Scalability and Flexibility

As your workforce changes, our systems adapt. Our Wellington payroll team provides scalable solutions that grow with your business and can be tailored to fit specific needs.

Key Features of Our Payroll Services

- Automated Payroll Calculations: We use advanced software to calculate salaries, taxes, and deductions quickly and accurately.

- Tax Filing and Deductions: We manage PAYE filings, employee deductions, and payments to the IRD, keeping you compliant and up to date.

- Direct Deposit and Pay Distribution: We ensure employees are paid seamlessly via direct deposit or physical payslips.

- Employee Self-Service Portals: Staff can securely access payslips, tax documents, and personal payroll data at any time, reducing administrative workload.

Choosing the Right Payroll Service Provider

Selecting a payroll provider should start with understanding your business’s size, structure, and pay frequency. Compare service offerings and ensure the provider has the right mix of experience, flexibility, and technology. Always check the provider’s reputation and commitment to customer support before making your decision.

If you are ready to simplify your payroll and streamline your business operations, contact us for more info by filling in an enquiry form or e-mailing or calling us during office hours.

Integrating Payroll with Business Systems

Efficient payroll management means ensuring seamless communication between systems. We make sure your payroll integrates perfectly with accounting software such as Xero or MYOB. We can also connect your payroll with HR systems to create a unified database of employee and financial information, ensuring accuracy and reducing manual work.

Managing Payroll for Small and Medium-Sized Businesses

SMEs face unique challenges, from limited resources to complex payroll legislation. At Long + Cowan, we understand these pressures. Our tailored Wellington Payroll Services provide practical, scalable solutions that make payroll simple and stress-free.

We help businesses:

- Customise payroll for full-time, part-time, and contract staff

- Stay compliant with New Zealand employment regulations

- Analyse payroll data for strategic insights and budgeting

Streamlining Payroll Through Technology

Modern payroll is driven by automation and cloud-based systems.

- Cloud-Based Access: Manage payroll securely from anywhere, without being tied to a single computer or location.

- Mobile Accessibility: Employees can check payslips and update information using mobile devices, improving engagement.

- Automated Workflows: We reduce manual tasks and errors by automating routine payroll processes.

- Real-Time Reporting: Gain instant visibility into payroll costs and trends to support better financial planning.

Navigating Compliance and Legal Obligations

Staying compliant is non-negotiable. We ensure that your payroll processes align with New Zealand tax and employment law.

- Legislation Updates: We stay informed about regulatory changes so you remain compliant.

- Payroll Tax and Filing: We manage payroll taxes, filings, and IRD submissions accurately and on time.

- Employee Entitlements: We monitor leave, benefits, and statutory rights to protect both your business and your staff.

Enhancing Employee Experience

Happy employees are more productive. Our payroll services support that by guaranteeing:

- Prompt and Accurate Payments every pay cycle

- Access to Financial Information through easy-to-use digital platforms

- Employee Financial Wellness Tools that help staff better manage their income

When payroll runs smoothly, morale improves and your business operates with confidence.

Custom Payroll Solutions

Every business is unique, so your payroll should be too. Our solutions are designed to meet diverse requirements, whether you manage a small team or a multi-site operation. We take a proactive approach, identifying opportunities to improve efficiency and prevent issues before they occur.

Payroll doesn’t have to be a chore. With Long + Cowan Chartered Accountants Wellington, you gain a trusted partner dedicated to transforming payroll challenges into long-term operational strengths. If you want to improve payroll accuracy, compliance, and employee satisfaction, contact us for more info by filling in an enquiry form or e-mailing or calling us during office hours.